PREDICTING THE RISK LEVEL OF A LOAN BASED ON THE CUSTOMER'S PERSONAL FACTORS USING MACHINE LEARNING

Objective

The primary objective of this project is to develop a robust machine learning-based system that predicts the credit risk associated with loans by analyzing borrowers' personal and financial factors. By identifying whether a loan poses a credit risk or not, the system aims to assist financial institutions in minimizing loan defaults and help individuals make informed borrowing decisions. This project seeks to promote financial awareness, enabling borrowers to avoid over-borrowing and financial distress. Through the integration of advanced machine learning algorithms, the system aspires to deliver accurate and actionable insights, fostering improved credit management and financial stability for all stakeholders.

Abstract

PREDICTING THE RISK LEVEL OF A LOAN BASED ON THE CUSTOMER'S PERSONAL FACTORS USING MACHINE LEARNING

ABSTRACT

Credit risk prediction in loan applications is a critical aspect of financial stability for both lenders and borrowers. This project, titled "Predicting the Risk Level of a Loan Based on the Customer's Personal Factors Using Machine Learning", focuses on assessing whether a loan carries potential credit risk or not. Many individuals face challenges in repaying loans due to financial mismanagement, leading to credit-related issues. To address this, the project aims to develop a machine learning-based solution that predicts the likelihood of credit risk based on customers’ personal and financial factors.

The primary objective is to help individuals and financial institutions make informed decisions by determining the credit amount a borrower can feasibly repay. By identifying potential risks beforehand, this application promotes financial awareness and assists in avoiding credit defaults, contributing to improved financial health for borrowers.

A variety of machine learning algorithms are employed, including Decision Tree, Random Forest, Support Vector Machine (SVM), Multi-layer Perceptron (MLP), Naive Bayes, and a stacking ensemble approach to enhance predictive accuracy. These models analyze diverse personal and financial attributes to classify loans as either "credit risk present" or "no credit risk present."

The project’s results are expected to provide a robust, user-friendly tool for evaluating creditworthiness, thereby benefiting a broad audience, including individuals, financial advisors, and lending institutions. By fostering better credit management practices, this initiative seeks to mitigate the risks associated with loan defaults.

Keywords: Credit Risk, Loan Prediction, Machine Learning, Financial Stability, Decision Tree, Random Forest, SVM, MLP, Naive Bayes, Stacking Ensemble.

NOTE: Without the concern of our team, please don't submit to the college. This Abstract varies based on student requirements.

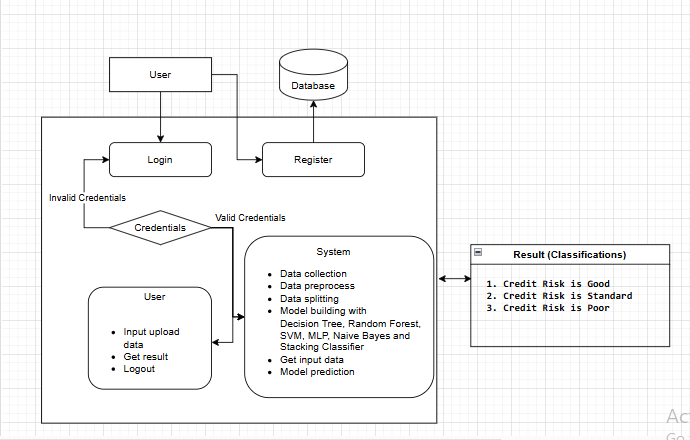

Block Diagram

Specifications

SYSTEM SPECIFICATIONS:

H/W SPECIFICATIONS:

· Processor : I5/Intel Processor

· RAM : 8GB (min)

· Hard Disk : 128 GB

· Key Board : Standard Windows Keyboard

· Mouse : Two or Three Button Mouse

· Monitor : Any

S/W SPECIFICATIONS:

• Operating System : Windows 7+

• Server-side Script : Python 3.6+

• IDE : PyCharm / VSCode

• Libraries Used : Pandas, Numpy, Matplotlib, OS.

Paper Publishing

Paper Publishing