Fraud Detection in financial transaction using advanced Analytical techniques

Objective

The objective of this project is to develop an advanced fraud detection framework using machine learning algorithms to accurately classify financial transactions into "Fraudulent transaction" and "Non-fraudulent transaction," enhancing detection precision, real-time processing, and scalability to protect financial systems from fraud

Abstract

Financial fraud poses significant threats to the integrity and security of financial systems worldwide. This project aims to develop a robust machine learning framework to detect fraudulent transactions effectively. Utilizing a publicly available dataset from Kaggle, we implement and compare the performance of various machine learning algorithms, including K-Means Clustering for unsupervised learning and Decision Tree, Logistic Regression, Random Forest, and Naïve Bayes for supervised learning.

The dataset is pre-processed through data cleaning, feature engineering, and normalization to ensure optimal model performance. K-Means Clustering is employed to identify underlying patterns and group similar transactions, providing a preliminary insight into the data. For classification, Decision Tree, Logistic Regression, Random Forest, and Naïve Bayes algorithms are trained and evaluated using metrics such as accuracy, precision, recall, and F1-score. Hyperparameter tuning is applied to enhance the models' predictive accuracy.

The results reveal the comparative strengths and weaknesses of each algorithm in detecting fraudulent activities. Our findings indicate that ensemble methods, particularly Random Forest, demonstrate superior performance in identifying fraud compared to individual classifiers. This project underscores the importance of integrating multiple machine learning techniques to enhance fraud detection systems. The proposed framework provides a valuable tool for financial institutions to mitigate fraud risks and safeguard their operations. Future work will focus on further improving model accuracy and exploring advanced techniques such as deep learning for fraud detection.

Keywords: Fraud Detection, Financial Transactions, Machine Learning, Unsupervised Learning, Supervised Learning.

NOTE: Without the concern of our team, please don't submit to the college. This Abstract varies based on student requirements.

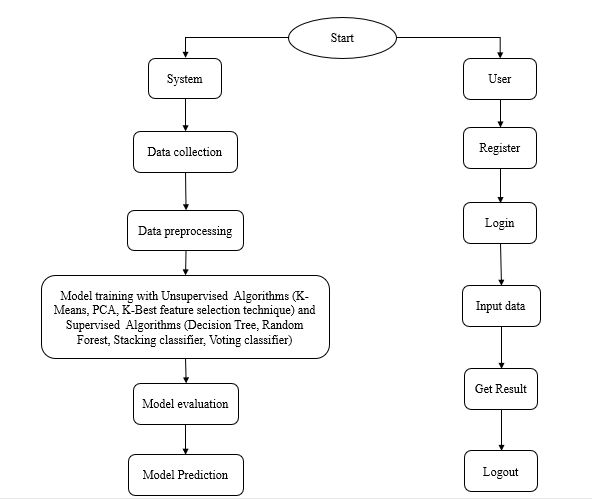

Block Diagram

Specifications

Hard Ware Configuration:

Operating system : Windows 7 or 7+

RAM : 8 GB

Hard disc or SSD : More than 500 GB

Processor : Intel 3rd generation or high or Ryzen with 8 GB Ram

Soft Ware Configuration:

Software’s : Python 3.6 or high version

IDE : PyCharm.

Framework : Flask, pandas, numpy and Scikit-Learn

Paper Publishing

Paper Publishing