Stock Price Prediction using DL

Objective

The main Objective of this project is to predict the price of the stock using deep learning architecture.

Abstract

Stock price volatility is a highly complex nonlinear dynamic system. The stock's trading volume affects the stock's self-correlation, self-correlation and inertial effect, and the adjustment of the stock is not to advance with a homogeneous time process, which has its own independent time to promote the process. LSTM (Term Memory Long-Short) is a kind of time recurrent neural network, which is suitable for processing and predicting the important events of interval and long delay in time series. Based on temporal characteristics of stock and LSTM neural network algorithm, this paper uses the LSTM recurrent neural networks to filter, extract feature value and analyze the stock data, and set up the prediction model of the corresponding stock transaction.

KEYWORDS: SME, Stress, detection, psychologists.

NOTE: Without the concern of our team, please don't submit to the college. This Abstract varies based on student requirements.

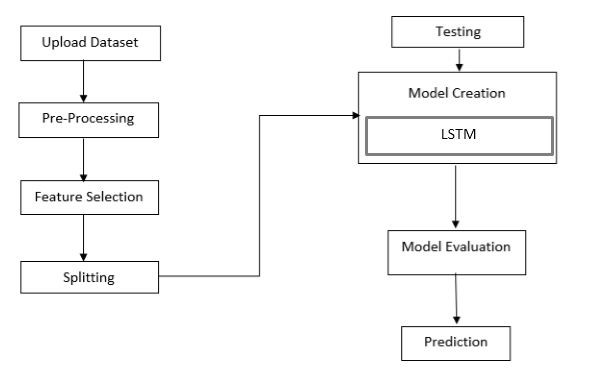

Block Diagram

Specifications

H/W SPECIFICATIONS:

- Processor: I3/Intel Processor

- RAM:8GB (min)

- Hard Disk :128 GB

- Key Board: Standard Windows Keyboard

- Mouse: Two or Three Button Mouse

- Monitor : Any

S/W SPECIFICATIONS:

- Operating System: Windows 10

- Server-side Script : Python 3.6

- IDE: Jupyter Notebook

- Libraries Used : Pandas, NumPy, Scikit-Learn, Keras, TensorFlow.

Learning Outcomes

· Practical exposure to

· Hardware and software tools

· Solution providing for real time problems

· Working with team/individual

· Work on creative ideas

· Testing techniques

· Error correction mechanisms

· What type of technology versions is used?

· Working of Tensor Flow

· Implementation of Deep Learning techniques

· Working of CNN algorithm

· Working of Transfer Learning methods

· Building of model creations

· Scope of project

· Applications of the project

· About Python language

· About Deep Learning Frameworks

Use of Data Science

Paper Publishing

Paper Publishing