Smart E-Banking Transactions

Objective

The major purpose of this project is to make transactions rapidly along with time reduction to improve digitalization. This process will improve the transaction speed. No need of contacting banks directly to make transactions over seas.

Abstract

The last decade has witnessed the emergence of a plethora of approaches for securing financial transactions over the Internet. During the same period, attacks have matured from isolated exploits to an organized e-criminal industry. In the midst of this evolution stood the End User, whose instances have often been neglected under the assumption that refunding financial losses is all that mattered. This paper analyses the existing deployments of banking services from the perspective of the End User, whose main goal is completing the online transaction. The sole use on the client side of so-called “trusted” hardware devices will be discussed and shown to fall short of the requirements for truly secure banking. A new metric for gauging the effectiveness of security software will be described and applied to measure the practical security of existing Internet banking systems.

KEYWORDS: Security, Online Transactions, End User.

NOTE: Without the concern of our team, please don't submit to the college. This Abstract varies based on student requirements.

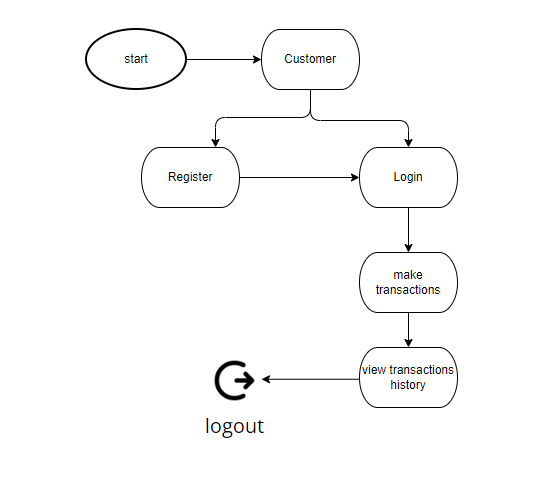

Block Diagram

Specifications

H/W System Configuration:-

- Processor : I3/Intel Processor

- RAM : 4GB (min)

- Hard Disk: 160GB

- Key Board : Standard Windows Keyboard

- Mouse : Two or Three Button Mouse

- Monitor : SVGA

S/W System Configuration:-

- Operating System : Windows 10

- Front End : HTML, CSS, BOOTSRAP

- Scripts : JavaScript, Jquery.

- Server side Script : Python

- Framework : Django, Flask

- Database : My SQL.

Learning Outcomes

- What is tender management?

- Understanding the issues of improper record maintenance.

- How contract planning can be done?

- About python packages and python language.

- What is hyper ledger technology?

- Use of HTML and CSS on UI Designs.

- Data Base Connections.

- Data Parsing Front-End to Back-End.

- Need of Pycharm-IDE to develop a web application.

- Working Procedure.

- Testing Techniques.

- Error Correction mechanisms.

- Input and Output modules.

- How test the project based on user inputs and observe the output?

- Practical exposure to

- Hardware and software tools

- Solution providing for real time problems

- Working with team/ individual

- Work on Creative ideas.

Paper Publishing

Paper Publishing