Investigation Of Applying Machine Learning for Watchlist Filtering in Anti Money Laundering

Objective

The main objective of the investigation is to explore the application of machine learning techniques for improving watchlist filtering in anti-money laundering (AML) systems. This involves evaluating the effectiveness of machine learning algorithms in enhancing the accuracy and efficiency of detecting potential money laundering activities by effectively filtering large volumes of data against watchlists of suspicious individuals or entities.

Abstract

Financial institutions must meet international regulations to ensure not to provide services to Criminals and terrorists. They also need to continuously monitor financial transactions to detect suspicious activities. Businesses have many operations that monitor and validate their customer's information against sources that either confirm their identities or disprove. Failing to detect unclean transaction will result in harmful consequences on the financial institution responsible for that such as warnings or fines depending on the transaction severity level. The financial institutions use Anti-money laundering software sanctions screening and Watch-list filtering to monitor every transaction within the financial network to verify that none of the transactions can be used to do business with forbidden people. Lately, the financial industry and academia have agreed that machine learning may have a significant impact on monitoring money transaction tools to fight money laundering.

KEYWORDS: SVC, Decision Tree and Naïve Bayes.

NOTE: Without the concern of our team, please don't submit to the college. This Abstract varies based on student requirements.

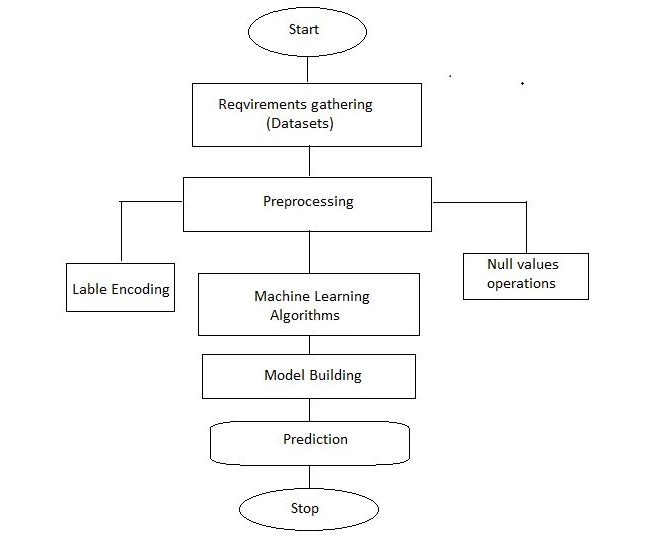

Block Diagram

Specifications

SOFTWARE FRONT END REQUIREMENTS

HARDWARE

Operating systeM: Windows 7 or 7+

RAM : 8 GB

Hard disc or SSD: More than 500 GB

Processor: Intel 3rd generation or high or Ryzen with 8 GB Ram

software:

Software’: Python 3.6 or high version

IDE : PyCharm.

Framework : Flask

Paper Publishing

Paper Publishing