A Comparative Approach to Predictive Analytics With ML For Fraud Detection of Real Time Financial Data

Objective

The ML models have long been used in many application domains which needed the identification and prioritization of adverse factors for a threat. Several prediction methods are being popularly used to handle detection problems. This study demonstrates the capability of ML models to detect the transaction frauds.

Abstract

Fraud has become a trillion-dollar industry today. Some finance companies have separate domain expert teams and data scientists who are working on identifying fraudulent activities. Data Scientists often use complex statistical models to identify frauds. However, there are many disadvantages to this approach. Fraud detection is not real-time and therefore, in many cases fraudulent activities are identified only after the actual fraud has happened. These methodologies are prone to human errors. In addition, it requires expensive, highly skilled domain expert teams and data scientists. Nevertheless, the accuracy of manual fraud detection methodologies is low and due to that, it is very difficult to handle large volumes of data. More often, it requires time-consuming investigations into the other transactions related to the fraudulent activity in order to identify fraudulent activity patterns.

Keywords: Financial transactions, Fraud, Patterns etc..,

NOTE: Without the concern of our team, please don't submit to the college. This Abstract varies based on student requirements.

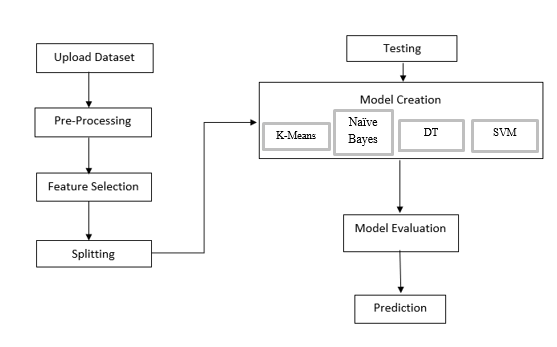

Block Diagram

Specifications

- Processor: I3/Intel

- Processor RAM: 4GB (min)

- Hard Disk: 128 GB

- Key Board: Standard Windows Keyboard

- Mouse: Two or Three Button Mouse

- Monitor: Any

- Operating System: Windows 7+

- Server-side Script: Python 3.6+

- IDE: Jupyter Notebook

- Libraries Used: Pandas, Numpy.

Learning Outcomes

- About Python.

- About Pandas.

- About Numpy.

- About Machine Learning.

- About Artificial Intelligent.

- About how to use the libraries.

- Virtualization.

- About model choosing.

- Project Development Skills:

- Problem analyzing skills.

- Problem solving skills.

- Creativity and imaginary skills.

- Programming skills.

- Deployment.

- Testing skills.

- Debugging skills.

- Project presentation skills.

Paper Publishing

Paper Publishing